A Podcast for Loan Officers Ready To Ramp Up Business

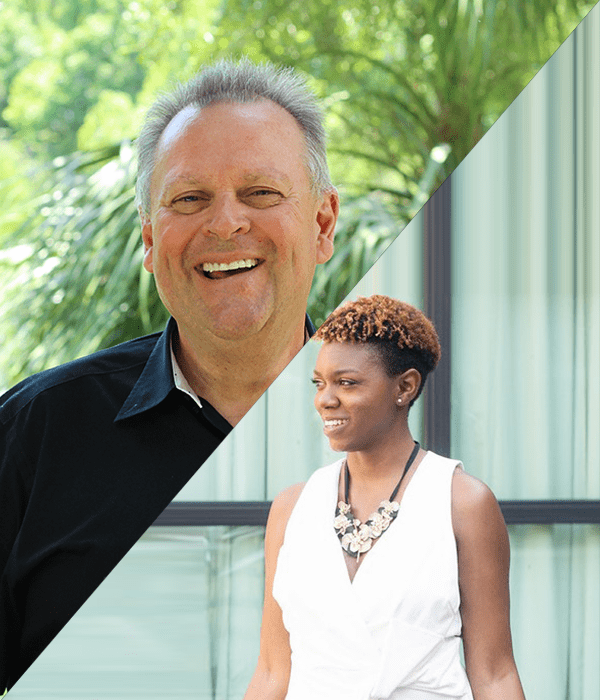

How To Use Facebook Ads To Close Even More Loans

Most Loan Officers are looking for ways to get even more business using social media marketing, be it on Facebook, Instagram, Tik Tok, LinkedIn, etc. But very few have mastered the art of using social media advertising to get even more business. On this episode of Loan Officer Freedom, the #1 podcast for Loan Officers, I’m sitting with my dear friend and Digital Marketing Specialist on my my team, Nina Barron.

Nina and I will be going over exactly what all loan officers should do when using Facebook ads to close even more loans. It’s not what you expect, but it’s been gangbusters for us and now, we’re sharing how you can do it too.

To get free access to even more strategies and helpful tips during this time visit: LoanOfficerSurvivalKit.com

How To Market During A Crisis Without Sounding Like An Uncaring Jerk

How can you continue to market your business in times of crisis? That’s exactly what I’m talking about today on this episode of Loan Officer Freedom, the #1 podcast for loan officers.

In times of crisis, it’s important that we stay positive. So how do you continue to reach out to your referral partners and database while showing strength, positivity, and leadership? I’m sharing two scripts for you to use to do just that.

To get free access to even more loan officer marketing ideas and helpful tips during this time visit: LoanOfficerSurvivalKit.com

This Is The Best Way To Stay Productive During COVID-19

On this episode of Loan Officer Freedom, the #1 podcast for Loan Officers, we’re talking about creative avoidance and what you should be doing first to stay productive right now while we’re all still in quarantine. Tune in to hear:

– The single best activity you should implement today in order to close even more loans.

– The script we use when calling our referral partners

– The script we use when calling our database

Are you staying productive during this time?

To get free access to even more strategies and helpful tips during this time visit: LoanOfficerSurvivalKit.com

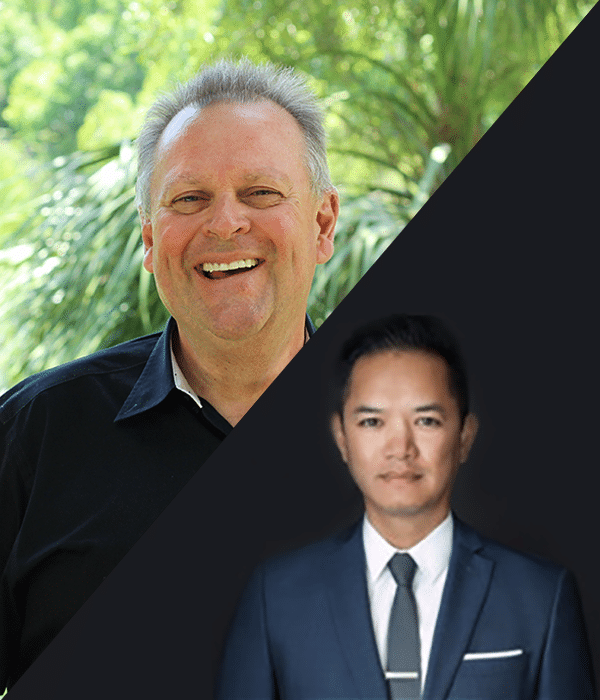

How To Prepare For Upcoming Challenges In The Market During COVID-19

Don’t you wish you would have known what to do 3 months ago in order to prepare for what’s happening today? Well my good friend and industry leader, Khai McBride, and I will be talking about that very subject on today’s episode of Loan Officer Freedom, the #1 podcast for loan officers!

Having experienced major shifts in our industry before, Khai and I have a list of things we wish we would have known prior to the shift in order to prepare. Today, we’re sharing that list with you. Things like:

– How much money we should have saved.

– What kind of marketing activities we should have implemented.

– Who we should have reached out to.

– & more

All of what we talk about today are things you can begin to implement right now in your mortgage business during these unprecedented times to help you gain clarity, increase your business, and continue to move forward during this global pandemic.

Setting Yourself Up For Success In The Midst Of COVID-19

What needs to happen in order to set yourself up for success in this kind of environment we find ourselves in during the coronavirus outbreak? I’m chatting with my friend Lacey today to discuss how she has gone from closing 3 units to 10 units per month, a 300% increase in business all while in the midst of Covid-19 health crisis.

Want to know what’s she’s doing to continue to build relationships with referral partners while we’re all quarantined? Or how she uses others’ talents to help her scale her business?

Find out during the latest episode of Loan Officer Freedom!

If you have questions about this topic, set up a complimentary coaching session at LoanOfficerStrategyCall.com

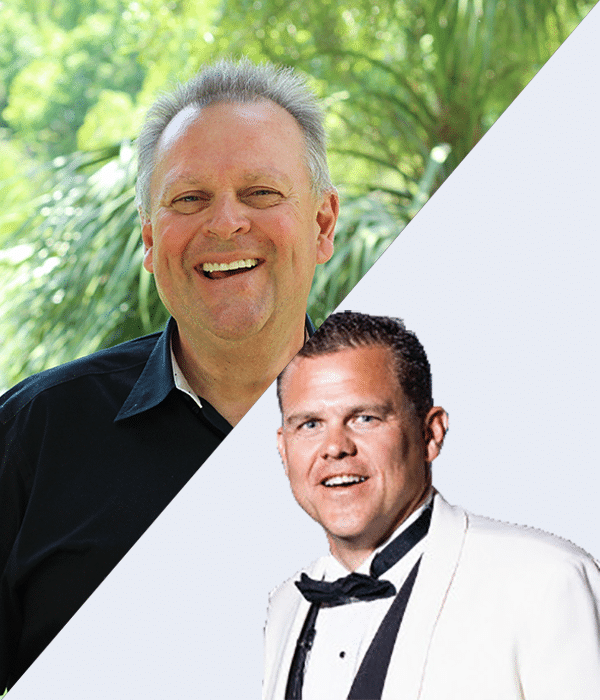

The Opportunities & Challenges LOs and Branch Managers Are Facing During COVID-19 Health Crisis

On this episode of Loan Officer Freedom, the #1 podcast for Loan Officers, I’m chatting with my good friend Owen. Owen is the Co-Owner of Success Mortgage Partners and has a unique perspective around the current state of our industry with the opportunities and challenges we have as Loan Officers and Branch Managers.

In this episode you’ll gain insight to what you can do right now to address both our opportunities and challenges during the coronavirus health crisis. We’ll discuss:

- Tremendous amount of business that’s able to be originated on both the refinance and purchase side.

- How to get more efficient using only 90 minutes per week.

- How and why you should update your realtor partners at this time.

If you have questions about this topic, set up a complimentary coaching session at LoanOfficerStrategyCall.com

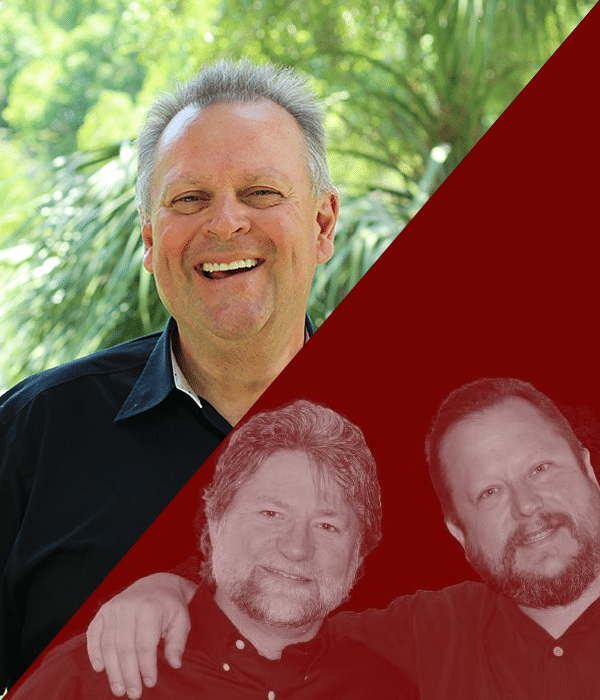

What Mortgage Loan Officers Should Be Doing During The COVID-19 Health Crisis With Barry Habib

On today’s episode of Loan Officer Freedom, we’ve got a special edition recording with some of my friends who are sharing some excellent insight and solutions for what we can be doing during the current situation we find ourselves in. A special thanks to Frank, Brian, Barry, and the rest of the gang for putting this together. Stay tuned for even more special edition episodes to provide you with the insight to come out ahead!

If you have questions about this topic, set up a complimentary coaching session at LoanOfficerStrategyCall.com

Story-Selling – One Of The Best Loan Officer Marketing Strategies

One of the greatest ways a Loan Officer can stand out in this industry is by “story-selling.”

On this episode of Loan Officer Freedom, the #1 podcast for loan officers, I’m speaking with the man and legend himself, Gibran Nicholas. Gibran is the man behind a couple of programs you may be familiar with, Momentify and CMPS Institute. Today, we’re talking about using stories to help our clients reach their goals and how positioning ourselves in a manner that is seen more as an advisor or guide can truly help us to increase our business.

We’ll share how you can determine the needs of your clients by asking questions like

- What’s their story?

- Where are they going?

- What are their challenges?

If you want to learn how to use your position and the service you provide as the solution to their challenges then keep listening.

If you have questions about this episode, set up a complimentary coaching call at LoanOfficerFreedomCall.com

How This Loan Officer Used Text Messaging To Increase Production

On this episode of Loan Officer Freedom, the #1 podcast for Loan Officers, I’m sitting with Mitch Mallahan who went from $10M in production to $22M in production over a 12 month period. Want to know one of his best marketing methods? Text messaging. If you’re interested in incorporating text messaging into your marketing plan, then this is the right episode for you. We’re going dive into the logistics of:

– How he sends out texts

– Who he sends texts to

– What he says in the texts

– How often the texts go out

Ready to take action and incorporate this strategy in your business. Keep listening. If you have questions about this topic, set up a complimentary coaching call at LoanOfficerFreedomCall.com