A Podcast for Loan Officers Ready To Ramp Up Business

Purchases and Refis ~ The 70/30 Approach

In this value packed episode of Loan Officer Freedom, Carl White and Steve Kyles enlighten you as to why they feel the 70/30 approach regarding purchases and refis in a loan officer’s production per month is what they refer to as the sweet spot. Follow their proven activities to steer away from complacent thought processes.

Join Carl and Steve as they share ways to clear the path, gather the tools, and turn your outlook around on hiring someone to increase your production. Don’t let overthinking detour you from learning how to delegate and build a team so you can do things that make you more money and begin to realize that even more is even easier.

If you’d like us to help you set up a successful plan to grow your mortgage business with strategies that we’ve shared on this episode, set up your complimentary strategy call today by visiting www.LoanOfficerStrategyCall.com

Building a Team to Build Your Business

On this episode of Loan Officer Freedom, the #1 podcast nationwide for loan officers, I’m joined by my friend and Freedom Club member, Landy Garcia.

Landy has built a world class team by learning that being aware of the boiling point during your mortgage business growth, helps you know when it’s time to hire.

He explains that when he started the increase from 5 to 7 loans per month to 10 to 11 loans per month, that’s when he felt the impact of not being able to do it alone.

Using the Axe of Freedom that Mortgage Marketing Animals has taught him in his coaching journey, he targeted certain areas where he needed help. That’s where the roadmap to success began, giving him more time with his family and to do the things he loves to do.

To learn more about the Axe of Freedom and building a dream team, connect with us one on one for a free coaching call with our top strategist. Schedule Now <entirely free>

Build A Solid Team, Get Better Results

On this episode of Loan Officer Freedom, the #1 podcast in the world, I’m joined by Adam Crosley out of CrossCountry Mortgage-Team Crosley, located in upstate New York.

Adam has built a team that takes on certain parts of the transaction process so that it is streamlined to be consistent and focused. This has allowed his mortgage business to pull in over 100 leads and 30 closings per month.

We’ll run through processes that he and his team use to automatically reach out to his database, and you’ll hear how he really puts in effort to build relationships.

If you want to learn more on how to structure your team for better results, schedule a complimentary strategy call today with us.

Show Up – Be Part of The Conversation – Create Your Reality

Positive energy is flowing when these two highly engaging superstars begin throwing gems of information on how surrounding yourself with greatness is the key to a productive day.

On this episode of Loan Officer Freedom, I hand the mic over to my good friends, Josh Pitts, host of The Shred Show, and Frank Garay, top industry leader and influencer of the mortgage world.

Frank tells us about his new zoom meeting and Facebook live movement, Loan Officer Breakfast Club, open to all loan officers nationwide to jump on and interact or even just listen in for inspiration and roadmap type direction for the reality of big success.

As Josh stresses in this episode, you’ve got to show up, you’ve got to be a part of the conversation, and be ready to embrace the industry changes as well as the marketing strategies that are working for LOs just like you.

Be part of the conversation Monday thru Thursdays from 8:30 – 9:00 am EST by registering at LoanOfficerBreakfastClub.com.

Ready to see what that roadmap looks like for your specific business? Jump on a complimentary call with us and we will set that in motion. Find a time that works for you here.

Visit LoanOfficerStrategyCall.com for more information.

GSD – Simply Put, Get Stuff Done

Do you ever feel that you aren’t worthy of the income you make or feel the imposter syndrome creeping up within you?

In this episode of Loan Officer Unplugged, Carl White and Steve Kyles, two of the most influential masterminds of the mortgage world, bring you another jam packed 30 minutes full of solid information gained from years of being successful branch managers.

Learn how to knock the walls down that you tend to build in your own mind by using what Carl refers to as GSD–and of course what he means is, Get Stuff Done. Why? What were you thinking?

Tune in and focus on the inspiring knowledge Carl and Steve share so you can implement these crucial steps of “watering the flowers and pulling the weeds.”

If you’d like us to help you set up a successful plan to grow your mortgage business with strategies that we’ve shared on this episode, set up your complimentary strategy call today by visiting www.LoanOfficerStrategyCall.com.

Part II–9 Ways To Make Mo’ Money

How To Close More Loans While Groovin’ Through Life…

Back to the grind? No thanks…we’d rather show you how to get back to the groove instead. In this episode, me and my good friend, Mike Cardascia, lay out detailed plans to make this happen for you and your business.

We recap on the actions we talked about on the part 1 of 9 Ways to Make Mo’ Money and continue the 9 steps here.

From getting a bigger cup to targeting bigger areas, you’ll make yourself more valuable leading to your goal of getting paid more without doing extra work.

Listen in while we clearly map out these proven strategies that has made loan officers increase their income dramatically.

If you’re interested in learning more in detail ways to make more with less stress and headaches, then connect with us one on one complimentary call. < no obligation >

Part I–9 Ways to Make Mo’ Money

Do you struggle with finding qualified agents? Maybe you don’t feel worthy enough to be in the million-dollar club? In this episode of Loan Officer Freedom, the #1 podcast worldwide for loan officers, I’m joined by my good friend and mastermind coach, Mike Cardascia, giving you part I of our ‘Make Mo Money’ series.

We will give you reasons to fight those intimidation fears, and why we know you are worthy of this, just like those currently pulling in that loan production.

Mike and I bounce ideas and highly effective marketing strategies off each other to get you on the path that we show our loan officers.

You’ll be able to use the right scripts for the right agents and find out how and where to target for the best and most efficient referrals possible.

Looking to find out how to make mo’ money? Let’s map out your best route on a complimentary strategy call here. < no cost >

Good Ole’ Fashioned Business Tools for The New Loan Officer

You’re in for a treat on this episode of Loan Officer Freedom, the #1 loan officer podcast in the world, as the tables turn when I am interviewed by an up-and-coming loan officer.

Hudson Beebe, based out of Spokane, Washington, is the youngest podcast guest I’ve ever had on. He runs down a list of basic, important questions about starting out as a loan officer and what he needs todo to get on the road to freedom.

I share with Hudson what I have experienced firsthand are the greatest basic strategies and activities to grow your mortgage business and structure it the best way possible.

The next generation is coming up the pipeline and I am honored to be the person that they reach out to with questions on what works when becoming a loan officer.

I’d love if you’d join us at our next Mortgage Marketing Animals event in Clear water to get even more strategies to plan out–Register here: MastermindRetreats.com

Ready to move to the front of the line on the calendar? Schedule here: LoanOfficerStrategyCall.com

NAMMBA Connect 2021 Atlanta – The Place to Be in September

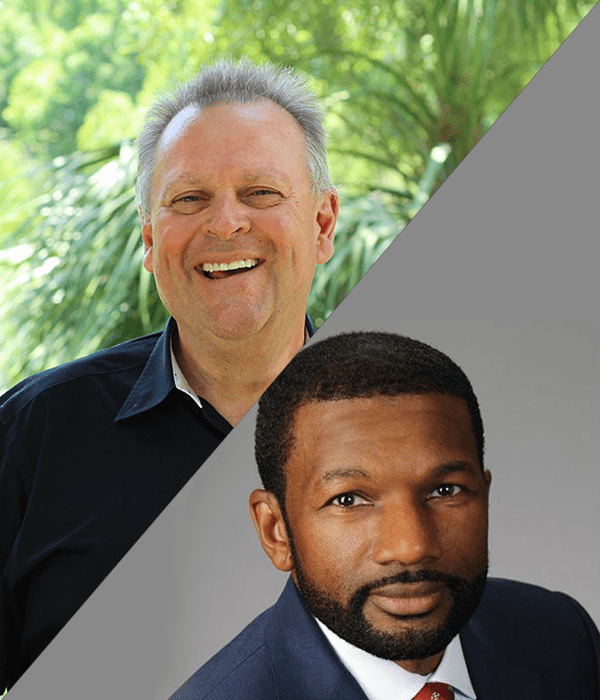

Are you ready to open your minds to what the future of the mortgage space is and be a part of the growth? Then listen in to Loan Officer Freedom, the #1 podcast for loan officers in the country, as Guest Host, Steve Kyles, in for Carl White, talks to Tony Thompson, Founder & CEO of National Association of Minority Mortgage Bankers of America, to learn more about this incredible opportunity in September of 2021.

The mission that NAMMBA is on to gather people of all kinds, ages, and cultures to connect them by creating relationships and providing the extensive knowledge to grow their business, is inspiring the next generation. Be a part of this – sign up today!

Get your tickets here!

If you’re a loan officer ready to take your business to new heights by closing more loans with less headaches, then let’s talk strategies. <no charge> Click To Schedule.