If you are considering becoming a Branch Manager (or perhaps you already are a Branch Manager), you may want to give some thought to whether or not you’d like to be considered “producing” or “non-producing.”

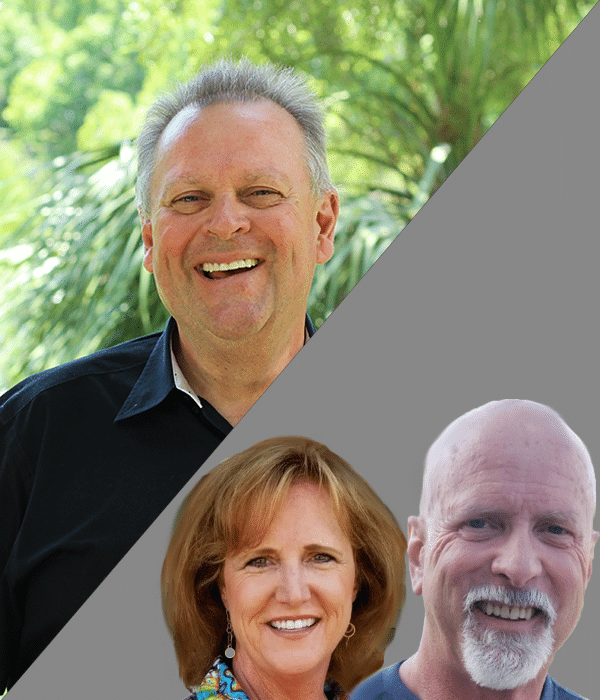

On this episode of Loan Officer Freedom, the #1 podcast for Loan Officers, Ralph, Kristin, and I discuss the ins and outs of each model and our own perspectives having been a Loan Officer, Producing & Non-Producing Branch Manager.

If you’d like help deciding which model may be best for you set up your complimentary coaching call at LoanOfficerStrategyCall.com