In this quick hit video, Carl White shatters the boundaries that loan officers place on their own business by breaking down these money making activities that made his buddy $64,239.98 in just one month. In these quick 7 minutes, you’ll see just how much easier it is than you would have ever thought. Let’s map out your 90-day plan to do this same process for you, step-by-step – totally free – Schedule Here: https://wrgo.io/TheMarketingAnimals/23888

Loan Officer Marketing

The “I have To Give 3 Cards” Script

So I was sitting in my office the other day and Sue, a loan officer who is a private consulting client of mine, sent me over a message as a quick SOS signal. Here was her message:

“I have a realtor with me right now – here’s the question: Her brokers (she is in FL) tell her that there is a “law” that she has to recommend more than one lender. I know there is no such law, but what do I say to her Carl? I need to know ASAP as I’m sitting with her now. Thanks!”

How many times have we all heard the ‘ol “I have to hand out 3 cards” response from agents?!

Now, some of the time, this is a real situation that is in agents’ minds that they really think they do need to hand out 3 cards based on some erroneous information that somebody has given them. Other times it’s nothing more than a “deflection” response from agents, you know, meaning that you really haven’t given them a reason to give out just your card…

… or better yet, YOU WANT AGENTS TO BREAK OUT IN A COLD SWEAT EVERY TIME THEY GET A BUYER LEAD UNTIL THEY HAND THAT LEAD OFF TO YOU!

You don’t actually want them to give your card to a prospect, who may or may not call you, by the way.

Instead…..

…you want the agent to tell the prospect you will be calling them, then that agent call you and give the referral to you. This ensures a solid connection, instead of the ol’ “well, I gave them your card, I’m not sure why they didn’t call you…” response from agents.

So here’s the script that I sent over to Sue, my private consulting client:

“Awesome, it’s an honor to be one of the 3. At least we know that 1 out of every 3 of your referrals will close on time and you will have great communication on the loan process, and that 1/3rd of the time that your leads will be followed up like great on a pickle, so at least on those, you will get even more referrals from them once they are in your past database. On the other 2, well, all bets are off.”

Now, let’s talk about that script for a minute and I’ll explain why it works so well, and give you some follow up information that will help you get a lot more referrals in other ways too.

A few years ago I sent a survey out to around 15,000 real estate agents asking them what their #1 complaint was with loan officers that they refer to.

Here’s what came back in the order of importance to them:

#1: They don’t close on time

#2: They don’t communicate with me on the loan process, I don’t know what’s going on with the file.

#3: The loan officer doesn’t follow up on my leads

So I knew right then what to focus on in my marketing to agents….

I call this my “Realtor Referral Getting” Checklist:

1. Close on time!

2. Communicate with them every Tuesday morning on what’s going on with the files we are working on together (either me or my team calls them with updates)!

[by the way, there’s another script my team uses to get tons more deals when we do those weekly updates. Be sure to ask me about the “Just Ask” script when you do your complementary strategy call with us by going here: www.LoanOfficerStrategyCall.com

3. Follow up on their leads relentlessly!

So you want to weave those 3 things in all of your marketing and scripts because those are the things they said are most problematic with their current lender they are giving all their referrals too.

When you cover those 3 things, you’ll get a deluge of business from agents…

…IT’S WHAT THEY WANT!!

But listen to this, it’s one thing to say you’re going to do those 3 things, it’s another to actually do them.

WE HAVE TO STRUCTURE OUR ACTIVITIES AND OUR STRATEGIES SO THAT WE ARE COVERING THOSE 3 THINGS!

But we can talk about how to structure “who’s doing what” in your current day to day activity to show you how to use your current resources to make those 3 things happen like clockwork during your strategy call. It’s way easier than you think…

…it’s just prior to now, nobody has shown you how…

… but once you know just a few things, you’ll see how epic your mortgage business can be, getting even more referrals and all with less stress

On your strategy call, we will be going over some other “loan getting” scripts too. This call will be a great source for even more free scripts

Go here now to see if there are any openings left for your complimentary strategy call

Good Ole’ Fashioned Business Tools for The New Loan Officer

You’re in for a treat on this episode of Loan Officer Freedom, the #1 loan officer podcast in the world, as the tables turn when I am interviewed by an up-and-coming loan officer.

Hudson Beebe, based out of Spokane, Washington, is the youngest podcast guest I’ve ever had on. He runs down a list of basic, important questions about starting out as a loan officer and what he needs todo to get on the road to freedom.

I share with Hudson what I have experienced firsthand are the greatest basic strategies and activities to grow your mortgage business and structure it the best way possible.

The next generation is coming up the pipeline and I am honored to be the person that they reach out to with questions on what works when becoming a loan officer.

I’d love if you’d join us at our next Mortgage Marketing Animals event in Clear water to get even more strategies to plan out–Register here: MastermindRetreats.com

Ready to move to the front of the line on the calendar? Schedule here: LoanOfficerStrategyCall.com

NAMMBA Connect 2021 Atlanta – The Place to Be in September

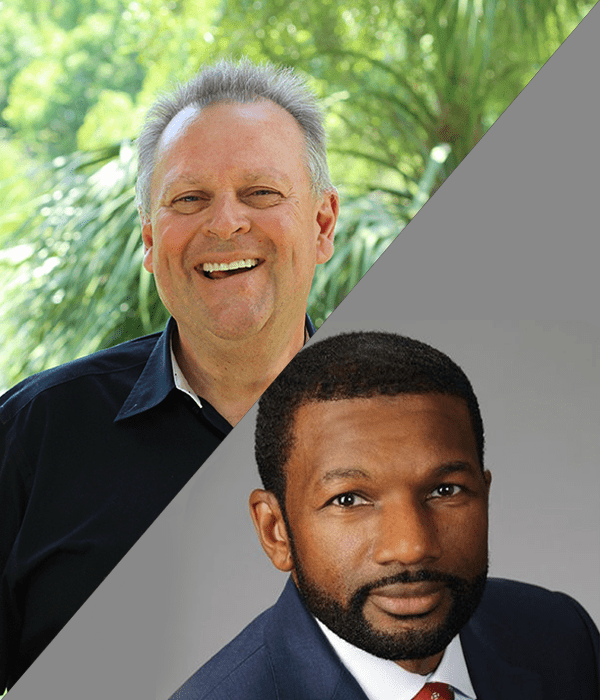

Are you ready to open your minds to what the future of the mortgage space is and be a part of the growth? Then listen in to Loan Officer Freedom, the #1 podcast for loan officers in the country, as Guest Host, Steve Kyles, in for Carl White, talks to Tony Thompson, Founder & CEO of National Association of Minority Mortgage Bankers of America, to learn more about this incredible opportunity in September of 2021.

The mission that NAMMBA is on to gather people of all kinds, ages, and cultures to connect them by creating relationships and providing the extensive knowledge to grow their business, is inspiring the next generation. Be a part of this – sign up today!

Get your tickets here!

If you’re a loan officer ready to take your business to new heights by closing more loans with less headaches, then let’s talk strategies. <no charge> Click To Schedule.

How to Make a Record Month Your New Normal as a Loan Officer

Loan officer careers are flourishing right now with interest rates at an all-time low. A lot of our Freedom Club and Mortgage Marketing Animals members are doing 3x and 4x their usual number of loans. We’re hearing stories of people who normally close just 3 or 4 loans a month closing 10 or 15 or more.

If this is you, how can you ensure that a record month becomes a new normal instead of just a welcomed fluke? I sat down recently with my friend Scott Hudspeth to figure this out. He chatted with me from Sunset Beach, Missouri in front of his motor home where he does most of his work these days.

2020 Changed Everything for Loan Officers

One thing this past year has shown us in the mortgage industry is that we can do a lot more virtually than we ever thought possible. Think of everything we’ve done differently since the pandemic.

- Not driving to the office

- Not going to the dry cleaner’s

- No more lunch dates with people who don’t even give us business

What could we do with this new freedom? We could use our extra time to cultivate and deepen relationships. We could get new referrals from our database. We could spend more time hanging out with friends. Some people have chosen to hit the road, homeschool their kids, travel, and see the world, like Scott and his family.

Scott says this year has changed everything for him. He’s not going to work with anyone ever again who needs to meet with him face-to-face. If someone tells him they need to meet him, he’ll say, “I’m not your guy.” He’ll hand them off to a good friend of his who can take care of them in that way. Maybe you don’t want to go to that extreme, but freedom sure sounds great, right?

Take Care of Your Realtor Partners

So, how can you set the bar at this new high, instead of preparing to go back down to where you were last year at this time?

One important thing that will assure you of continued success is taking care of your realtor partners. We’re obviously getting a ton of refi business right now, so some of us are neglecting our realtors. I know we’re busy, but we can’t do that. We need to stay focused on the bread and butter that will keep us busy well after the refi boom is over. It’s going to end. It’s a cycle. Do those refis, but keep strengthening, deepening, and building new realtor relationships.

We also need to crack the code of how to get to the buyer before they go look for a home. When I go buy a car, I don’t look for the money first. I go look at cars. Same with a house. We need those relationships with realtors, so they’re sending us their clients as soon as they get them. If you invest in your referral partners during these crazy busy times, they will remember you when things get back to “normal.”

You can ignore your realtors for a week or two or a month, but 90 days from now, you’re going to feel the pressure of that. The refis will dry up, and it will be too late. The work you do today is what’s going to put food on the table 90 days from now.

Keep Getting Referrals From Your Past Database

Money is the cheapest it’s ever been in the history of the mortgage industry right now. You have to let people know, have these conversations with clients, ask for referrals. This is one of the hottest loan officer tips I can give you right now. Ask for a referral in every single conversation. Don’t let any of them go to waste. One closed deal is no longer just one person. It’s the potential to close 10 more loans. Every single person you talk to has at least 9-10:

- close family members

- friends

- neighbors

- coworkers

- Facebook friends

They care about these people, and they would love for them to take advantage of what’s going on right now. You’re not being salesy. You’re offering value.

You Have to Hire Help

If you feel like you’re drowning, putting in way too many loan officer hours each week, and can’t keep up with those relationships, you have to get that non-money making activity off your plate. You have to continue to fire yourself from everything that isn’t selling or building/deepening a relationship.

Remember that 20% of your activity brings in 80% of your income. You have to hire people to do the work you don’t have time to do. People are afraid that, if they hire someone, things will slow down. Let me tell you a fact: if you don’t hire someone, things will slow down.

At our company, we offer people an opportunity to work at a wonderful place with a great boss. It’s my employees’ responsibility to seize that opportunity and help us grow. I don’t give my team job security. They give themselves job security by creating value and helping us bring in new customers. And that secures their job. If they can’t or won’t do that, this isn’t going to work out so well for them.

We attempt to conduct our business when we’re having these record months at 20, 40, 60 loans the same way we did when we were closing 2 or 3 loans a month. You can’t do that. You have to let go of more and more responsibility.

Your clients want the money, the house, the keys. They don’t need you at the closing table with your hand on their knee. We’ve found out that Zoom meetings are converting higher realtor relationships than face-to-face coffee meetings. You can let go.

What Huge Producers are Doing Differently

Time is the one thing we all have an equal amount of. What are these huge producers doing differently?

They let go.

Do you take applications by phone or send potential clients to an online application? You don’t need to hang on to that practice of taking applications by phone. It takes too much time. They can apply online over the weekend, and your assistant can grab it and get the process going.

Scott told me that, years ago, when he was doing all his loans himself, I told him to just let one thing go to someone on his team and see what happened. Nothing bad happened. Let another thing go. Nothing bad happened again. His clients were still happy, even happier actually, because the other person was more available than Scott was.

Letting go is really hard at first. It gets easier. Trust me.

You Are Absolutely Worth It

I can’t stress enough how important it is that you see yourself as worthy of these new numbers, that it’s not just a lucky month. You’re having this success because you’re doing the right activities. You’re worthy. All of us are worthy of great and wondrous things. Your success didn’t happen because of luck. It happened by design. You’re leveraging your talents and other people’s talents. They’re leveraging your talents. It all works together.

If you find yourself in a record month, embrace it. Consider it your new normal. Make sure you’re doing that proactive activity to keep that forward momentum going. Make sure that the loans you’re bringing in close, and you focus your time on building new (and old) relationships with referral partners.

And just know that it’s not going to happen overnight. If you plant a seed today, it won’t be full-grown by tomorrow. It’s going to grow in 90 days, 120 days. Where you put in the effort today will yield itself three months from now. Just keep faithfully planting seed after seed.

If you need help planting those seeds and planning your figurative loan officer garden, we can help you with that. Today is the perfect day to schedule a FREE strategy session with us. This small step could lead to such big things, friend. Invest in yourself and your future today. You’re worth it.