Have you ever run into this situation before?

Borrower: “What’s your rate?”

You: [Your rate]

Of course you have, we all have! Here’s the thing, borrowers have been trained and conditioned to ask about rates and that’s okay. It’s okay if some people shop us sometimes.

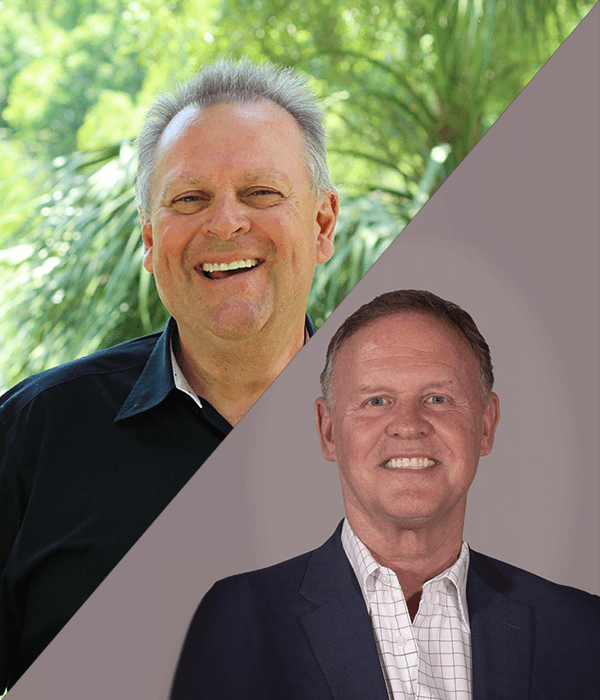

On this episode of Loan Officer Freedom my dear friend and leader in the Freedom Club, Kevin Gillespie, and I will discuss how we handle rate shoppers and what you can do to BEFORE and AFTER they’ve asked the inevitable question…what’s your rate? We’re going to go over a few strategies and share a script with you. If you’d like to go over even more scripts and strategies set up your complimentary coaching call with one of our coaches at LoanOfficerFreedom.com/StrategyCallRequest