Tanner Ellis, a loan officer in our Freedom Club, went from 14 referrals resulting in$1.8MM in closed volume the month before, then figured out a way to get 32 referrals last month that resulted in 9 loans or $4.1MM in closed volume.

That means closing 1 loan for every 3 to 4 referrals.

“How did he get 32 referrals?” you ask…

Coach Doug told me it was by doing the Daily Success Plan and getting referrals from the handful of loans he was already doing and his past database.

That’s like free money!

Come to find out, in this case study, he simply spent time prospecting using the proven (and trademarked) Daily Success Plan.

Because of the increased closed loans (and more $$ in his pocket), he had room in his budget for some much needed help.

I have found that when you have help, you close even more loans with even less stress, which means even more $$ in your pocket while you are enjoying life even more.

When you are ready to see the plan that’s responsible for all of this coolness, pick a time and date here that works best for you and we’ll do a 1 on 1 Zoom call and walk you through it <no charge>.

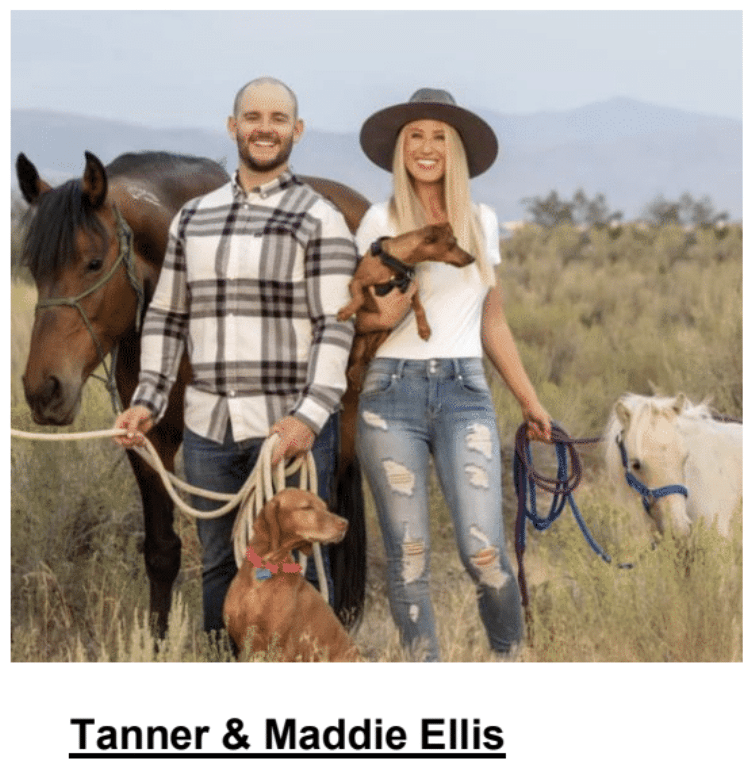

Helping cowboys and cowgirls close more loans for decades and decades☺