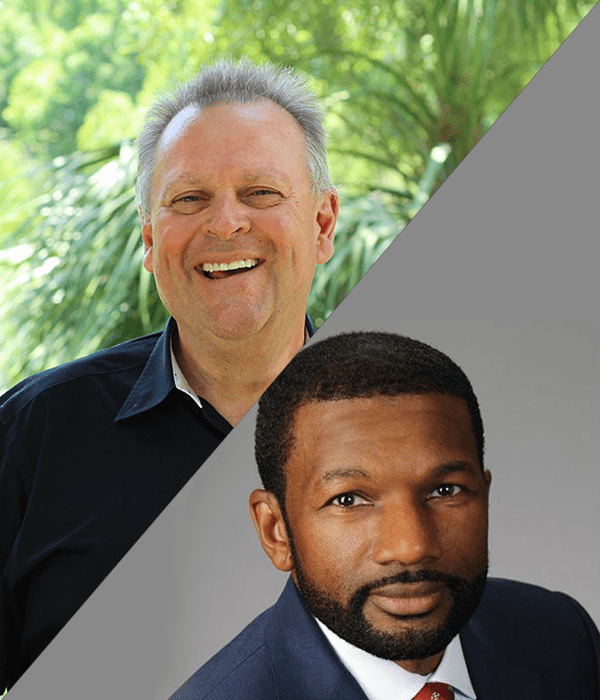

On this episode of Loan Officer Freedom, the #1 podcast in the world, I’m joined by Adam Crosley out of CrossCountry Mortgage-Team Crosley, located in upstate New York.

Adam has built a team that takes on certain parts of the transaction process so that it is streamlined to be consistent and focused. This has allowed his mortgage business to pull in over 100 leads and 30 closings per month.

We’ll run through processes that he and his team use to automatically reach out to his database, and you’ll hear how he really puts in effort to build relationships.

If you want to learn more on how to structure your team for better results, schedule a complimentary strategy call today with us.