One thing I’ve learned over the years is this:

Going after whales (top producing real estate agents) is actually easier than chasing minnows.

Most loan officers assume the opposite, that whales are harder to reach, tougher to talk to, and more resistant to sales activity.

But here’s what I’ve found.

Whales recognize sales activity.

They respect it, because it’s the same activity they commit to every day.

It feels familiar, not pushy.

“Salesy” and “Chasing” are only words used by low producers (or somebody trying to sell you something that you totally don’t need).

Sales activity and sales conversations is exactly what top producing agents are doing themselves and like it when you talk to them in that same fashion.

That leads to two simple Saturday guidelines if you want to attract a whale in the first place:

1. Do consistent top producer behavior (even before you are a top producer)

Visible discipline. Outbound conversations. Intentional relationship building.

When a whale sees that in you, they lean in, because that’s their language.

2. Whatever you do, don’t hunt random shiny “minnows”

No scattershot posts. No gimmicks. No weekend chaos.

Whales aren’t impressed by noise and glitter. They actually guard themselves against those things.

They move toward certainty and discipline.

Come to find out, whale hunting is actually easier, not harder, when you’re operating the way whales already operate.

And the good news?

This mindset is just one of the 11 classes we’re doing at my next live event in Clearwater Beach, March 3rd and 4th.

Pipeline Accelerator Event

“A Leads, Conversions, Closings Workshop”

When you are ready for 2 days of encouragement, scripts, structure, and confidence-building strategies designed to help you stop chasing minnows and start building a whale-based business, you can get registered here:

Click the link to grab your seat

Don’t get left out!

Carl White

P.S. If you want to attract a whale, remember this:

Be the one who calls on purpose, not the one who posts in panic.

Whales swim toward certainty, not splashing.

And if you want more structure for your predictable pipeline, the Clearwater Beach event is where we go deep on this stuff, mindset, scripts, and implementation you can actually use.

If you’ve been winging your outreach or avoiding realtor conversations because you weren’t sure what to say… you’re not alone.

Most top producers once felt that way too, they just found a better structure.

Click this link. Grab your seat. And join the top producers.

See you at the beach.

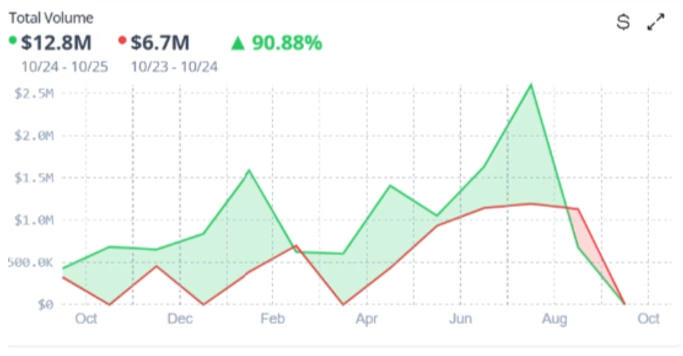

Red line = last year

Red line = last year Green line = this year

Green line = this year